In this article

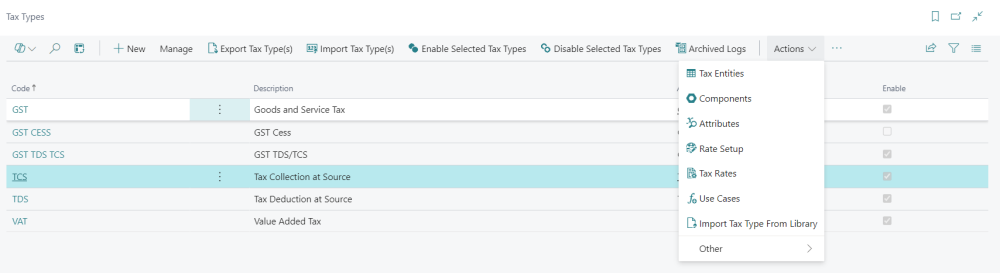

To set up the TCS Tax Type in LS Central IN:

- Click the

icon, enter Tax Types, and select the relevant link.

icon, enter Tax Types, and select the relevant link. - Locate the TCS code, and then select the related link.

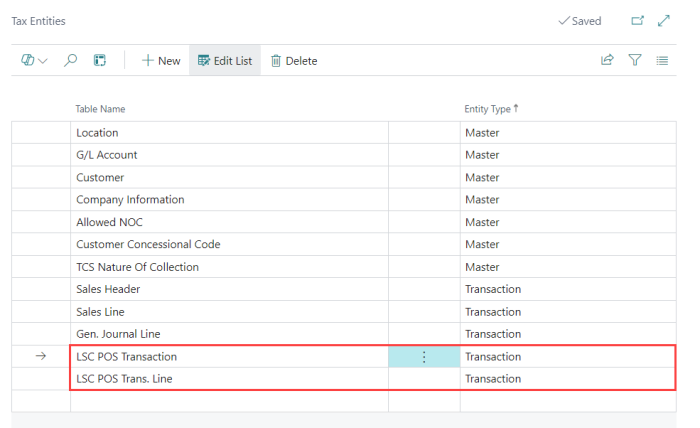

Tax entities

TCS calculation at the LS Retail POS involves a new set of tables to which the tax entities should be added.

- Add a new Table named LSC POS Transaction with the Entity Type set to Transaction.

- Add another Table named LSC POS Trans. Line with the Entity Type set to Transaction.

This lets you configure use cases based on these new tax entities.

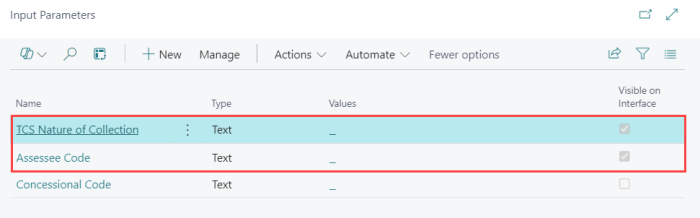

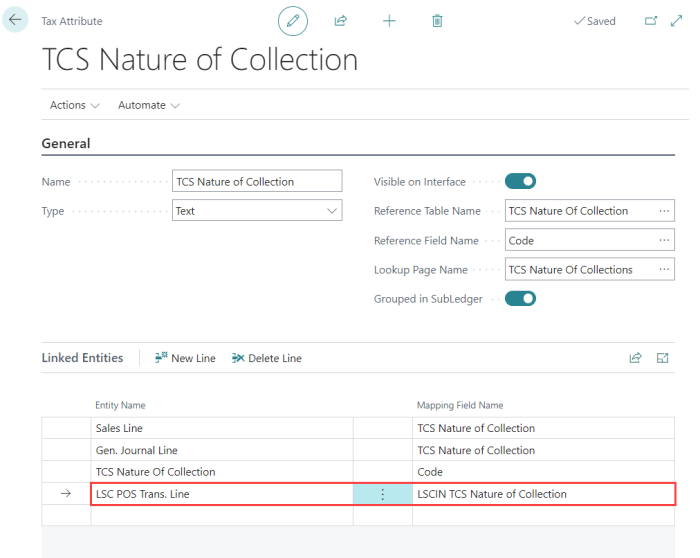

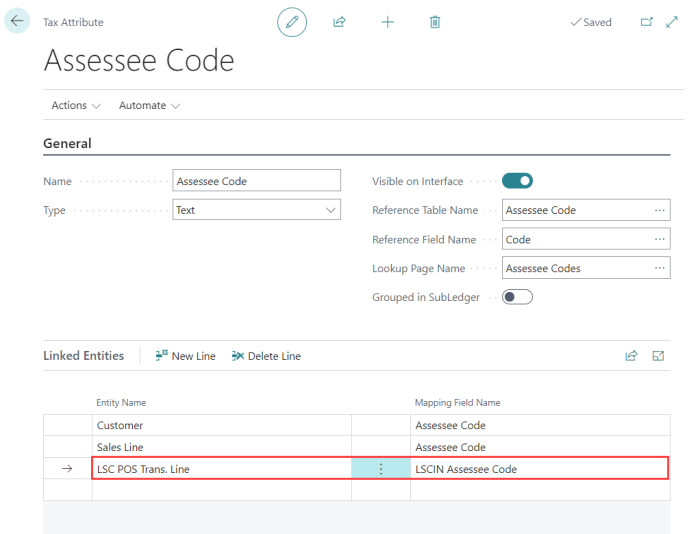

Tax attributes

A tax attribute will be used as parameters for tax rate configuration.

-

Link the LSC POS Trans. Line entity to the LSCIN TCS Nature of Collection mapping field.

-

Similarly, link the LSC POS Trans. Line entity to the LSCIN Assessee Code mapping field.

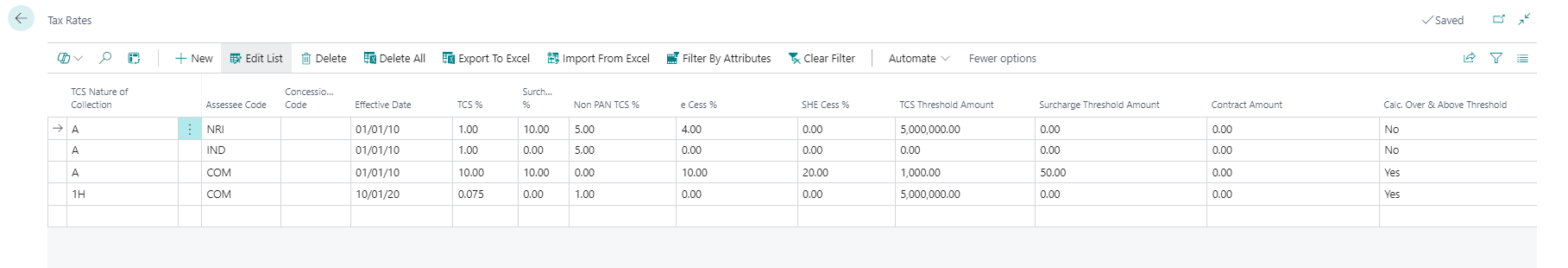

Tax rates

- Configure the TCS rates (for example, percentage for TCS, Surcharge, e Cess, SHE Cess, Threshold Amount for TCS and Calc. Over & Above), based on the TCS Nature of Collection and Assessee code for different transaction types.

- Set TCS Threshold: Define the transaction value at which TCS applies (for example, if TCS applies only when a transaction value exceeds ₹1,000.00).

- Set Surcharge Threshold: Define the threshold amount for which the surcharge will apply (for example, ₹50.00).

- Calculation Over & Above Threshold:

- Set this option to Yes, if TCS should be calculated only on the amount exceeding the threshold.

- Set this option to No, if TCS should be applied to the entire transaction amount, regardless of the threshold.

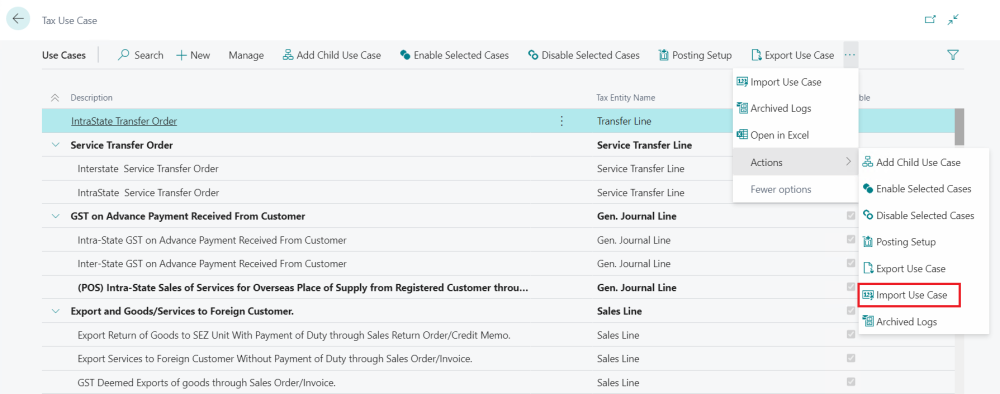

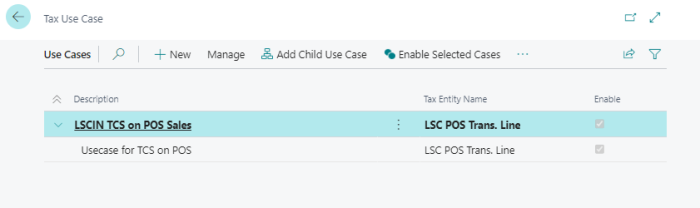

Use case

A use case describes a business scenario, conditions, and events that trigger tax calculation. The use case can be enabled or disabled based on the business's need.

- Import the use case JSON file LSCIN TCS TaxUseCase.json from the IN localization folder in the LS Central release package.

- After importing, TCS tax is calculated in the POS transaction line.

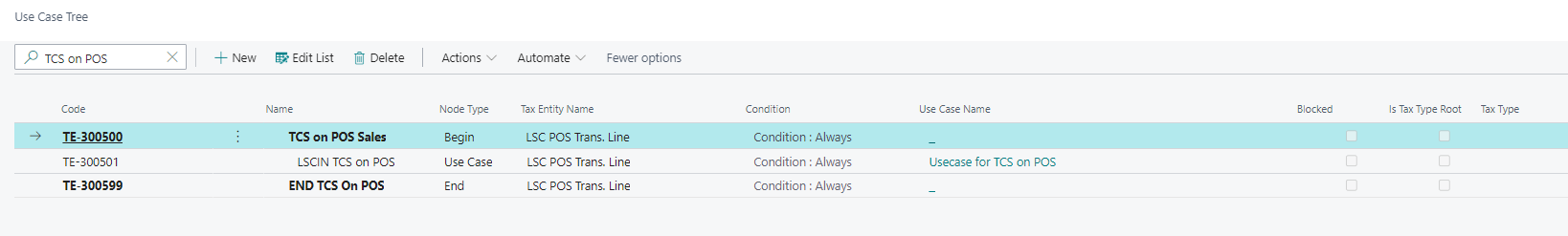

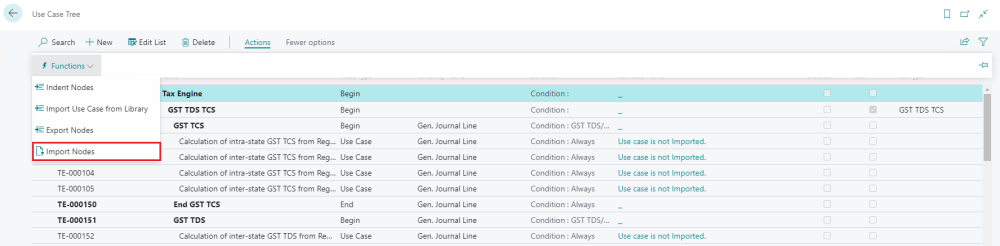

Use case tree

A use case tree makes a use case applicable.

- Search for Use Case Tree, and select the relevant link.

- Select Import Nodes to import the use case tree JSON file LSCIN TCS UseCaseTree.json from the IN localization folder in the LS Central release package.

-

After importing, TCS tax is calculated for POS sales as defined in the use case.